Die drei Irrglauben, die Implantate und Medikamente unnötig verteuern

#1: Ehrliche Preise

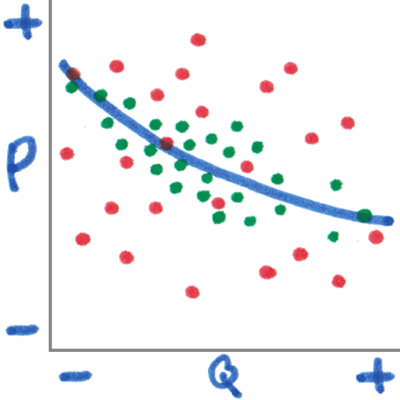

Laut den Herstellern gibt es eine hohe Korrelation zwischen der gekauften Menge (Q) und dem bezahlten Einkaufspreis (P)—die grünen Punkte im Bild. Dazu sind die Gewinne niedrig und alle Kunden werden gleich behandelt.

Tatsächlich sind die Preise willkürlich—die roten Punkte—und Größe bestimmt nicht, wie günstig eingekauft wird.

#2: Alle Einkäufer sind

gleich schlau

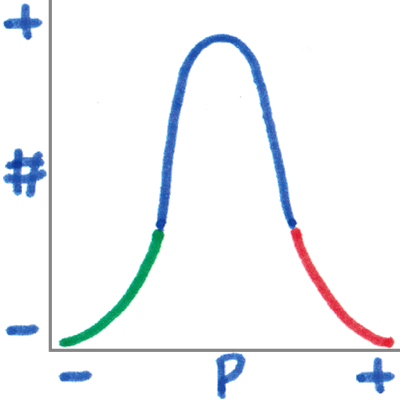

Die Preise für Implantate und Medikamente folgen einer Normalkurve: einige zahlen niedrige Preise (grün im Bild), andere sehr viel (rot) und der Rest liegt dazwischen (blau). Einkäufer sehen sich selbst mehrheitlich im unteren Viertel.

Fakt ist, dass 75% der Krankenhäuser Preise zahlen, die nicht zu den unteren 25% gehören.

#3: Einkaufsverbände

sind die Lösung

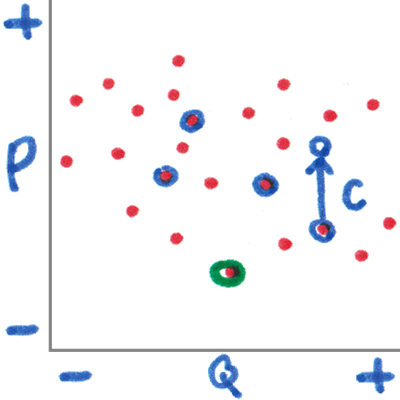

Einkaufsverbände sehen nur ein Teil des Marktes: zum Beispiel in der Grafik, nur die Punkte mit blauem Rand. Zum niedrigsten Preis kommen noch Verwaltungskosten (C), die auch von den Mitglieder bezahlt werden.

In Wirklichkeit erzielen direkt kaufende Krankenhäuser häufig bessere Einkaufspreise als Verbände (der grün umkreiste Punkt im Grafik).

medixfair ist überall einsetzbar

Auf Ihrem Rechner im Büro, auf dem Tablet und sogar unterwegs von Ihrem Handy. Sie haben überall Zugriff auf den Preisvergleich, den medixfair zur Verfügung stellt.